Insurance Data Science Conference returned again for the third year.

The 2021 Insurance Data Science Conference involved both academic and industry practitioners in a variety of areas, spanning from data science, machine learning & AI, to computational statistics and software development. These topics were presented in the context of applying them to the insurance industry. Mirai was once again a proud sponsor of the event together with the SwissRe Institute.

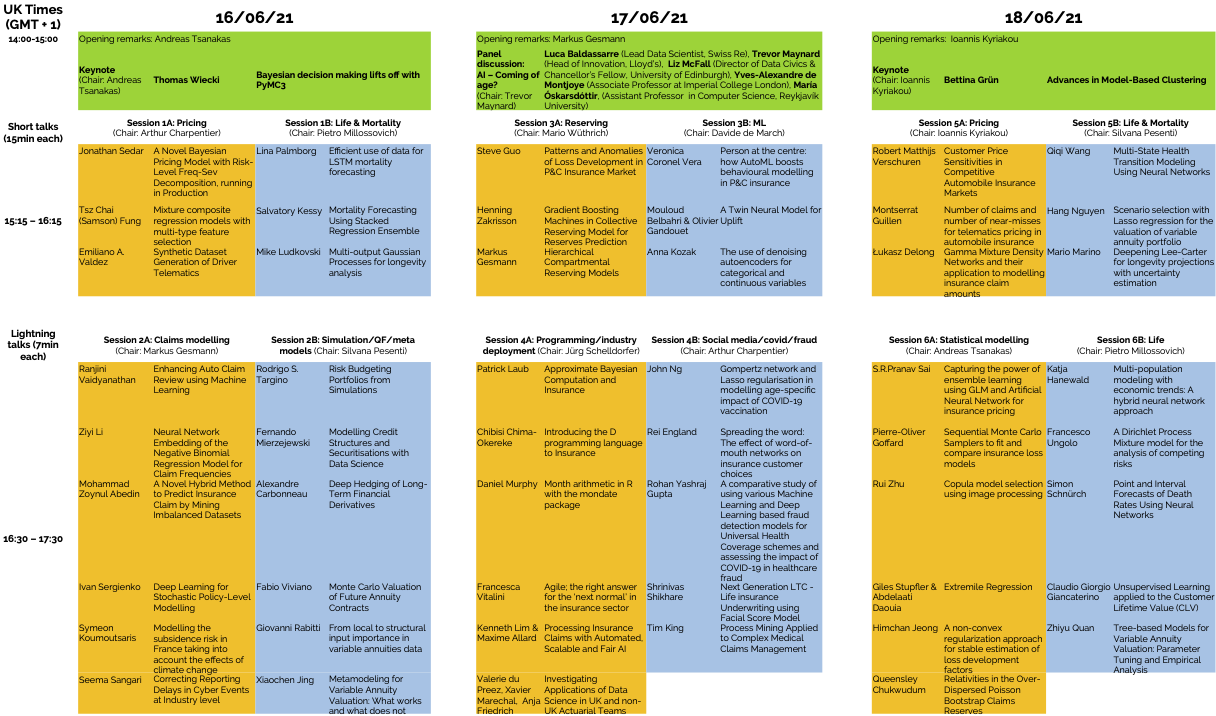

IDSC2021 took place online during three afternoons (BST timezone) between June 16th-18th. It included a variety of formats (from Zoom webinars to breakout rooms and breaks on gather.town) to allow for interesting talks and panel discussions, while enabling some interactivity and networking.

Keynote talks were given by:

- Bettina Grün, Professor at the Institute for Mathematics and Statistics at the Vienna University of Business and Economics: she gave a deep-dive talk on advances in model-based clustering.

- and Thomas Wiecki, CEO and founder of PyMC Lab: he opened the conference with a talk about Bayesian decision making with PyMC3 and an application to insuring rocket launches.

Additionally, an interesting panel discussion took place on Thursday 17th about the coming of age of AI, expertly moderated by Trevor Maynard (Head of Innovation, Lloyd’s), and featuring:

- Luca Baldassarre (Lead Data Scientist, Swiss Re),

- Liz McFall (Director of Data Civics & Chancellor’s Fellow, University of Edinburgh),

- Yves-Alexandre de Montjoye (Associate Professor at Imperial College London),

- María Óskarsdóttir, (Assistant Professor in Computer Science, Reykjavík University.

They discussed the latest trends in AI and insurance, focusing on ethics and how much can you trust AI when it comes to fraud, insurance policies and claims. The question: “Will trusting AI ever be like trusting your doctor?” generated quite an interest in the audience, and kept the discussion going even after the end of the panel.

Mirai was of course present as part of the program with Francesca’s lightning talk: “Agile, the right answer for the ‘new normal’ in the insurance sector” in the “Programming/industry deployment” session, where she discussed benefits and pitfalls of being agile for a data science team and an organization in the insurance sector. Her slides are available on the conference website. The session included many other interesting talks, among which an introduction to the D programming language by Chibisi Chima-Okereke, a discussion of how to represent a month in R from an actuarial (or more generally business) perspective by Daniel Murphy, and a study of data science adoption in actuarial teams by Valerie du Preez, pinpointing how collaboration and bridging silos is a trend, which we as agile advocates strongly support.

Read more about the conference and other sessions with several interesting techniques and propositions applied to areas like pricing, reserving, life insurance or general statistical modeling on the IDSC website.

Kudos to the organizers for the smooth organization of the conference, and to all the speakers and participants for making it a valuable event. Very much looking forward to what will hopefully be an in-person event next year in Milan!